The EU plan to curb its dependence on US$ during the post-Trump era, how about Japan?

日本語版: EUはポストTrump時代のUS$に対する依存を抑制する計画をセットします、日本はどうですか?

According to Financial Times and RT.com, "EU wants to shield itself from US sanctions and cut dependence on dollar", even though Trump is stepping down. Why and what does this mean?

"Frustrated by US unilateral sanctions under the Trump administration, the European Commission is reportedly working on a plan to assert its financial and economic autonomy and limit the bloc’s reliance on the greenback."

Background 1

US$ is the de-facto world currency, so every extra $ America prints is effectively a taxation on the world. America has double deficits, budget deficit and trade deficit. The budget deficit is the extra US$ Americans print, then they spend the money out internationally through trade deficit, which is the gap between the import value and export value of America. Since America is never ever going to have a trade surplus, so every penny of US trade deficit is actually a stealing. Not only that, since they print too much money, there will be inflation, which will reduce the value of US$ savings of various countries in the world, including Japan. The more saving in US$ you have, the more you will be stolen from.

Before Trump, the accumulated US federal budget deficit is about US$20 trillions, per-year deficit is ~US$ 600 billions (This is roughly equal to America's trade deficit). Since the master of bankruptcy Trump came into power, the per-year US budget deficit has soared to US$1 trillion, and in 2020 the deficit reached US$ 3.3 trillions. In 2021, the projected US budget deficit is US$ 2.2 trillions.

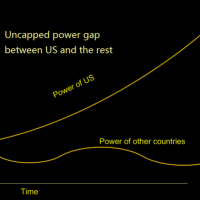

Putin calls US a leech on world economy, that's really a understatement for a stealing worth of US$ 600 billions per year. What's even more worrying is the long term accumulating effect of this stealing, imagine America keeps stealing US$ 600 billions each year for 50 or 100 years, not only living leisurely but also spending heavily on the military! I pointed out that America will then evolve into a super carnivore lion while all others reduced to its food.

Even for countries that do not have trade surplus with US, it's still a big problem. Because this stealing gives US a huge advantage in international competition. This extra stolen wealth can then be put into various use and its effect will be amplified. For example, to attract best talents from around the world by giving them better pay, or to enhance military power by expending more.

For any country with this much budget deficit, it will go bankrupt, but not for America. Instead, America continue to shamelessly maintain or even increase its huge military spending by utilizing the wealth it steals. American military spending is roughly the next ten countries' combined military spending. The American military power supported by the stolen wealth through US$ reinforce the US dollar hegemony, so the two are mutually reinforcing each other, that's the gist of America hegemony.

Americans may argue that, since it pays interests to its foreign debt, so it should not be called stealing. This argument is wrong and misleading. Since: 1, America borrows more money than the interests it pays, so it is a Ponzi scam which relies on later borrowing to pay for interests of earlier debt. The newly borrowed money, i.e. the trade deficit per year is far greater than the interests it pays per year. The debt that US owes to the world will keep growing and growing. 2, A big portion of foreign savings in US$ earns little or no interests at all from America. 3,What's worse is that America is constantly devaluing the dollar through inflation and put policy restrictions on foreigners' ability to buy American property with US$, so the value of its debt is reduced constantly and unknowingly. This is because US budget deficit is higher than trade deficit, they need to print new money, and this churning-out of new money has reached US$ ~3 trillions in 2020. In contrast, Japan's 2020 GDP is only ~US$ 5 trillions. Through this mechanism, Americans don't have to worry about American real wealth and properties flowing out to foreigners' hands, and America can keep stealing from the world cozily, unlimitedly and indefinitely.

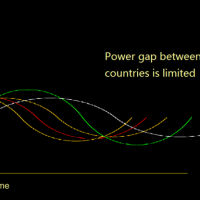

Both EU and Russia are very serious on the issue of US$, for the world to solve this problem, Japan, South Korea and China must join the force. All the major powers have to unite together to confront the only super power on earth.

By the way, America is constantly fostering new major sources for it to leech from, China is now one of the major sources, but America is trying to develop India into its next major source. So there is this hype of Indo-pacific strategy and manufacturing supply chain shift. I guess that I am the first one to point out this hidden agenda of America. I will talk about this in later posts, esp. on the environmental consequence of the supply chain shift.

Background 2

Besides all the above, there is also the issue of long arm jurisdiction by America, which has also hit Japan from time to time.

US$ is the de-facto world currency, the majority of international trade are carried out through US$. However, America controls the transaction of money paid in US$, and the savings of all countries in US$ are actually superintended by American government, America can sanction every country that dare to disobey its will, this gives America an enormous power over global economy and politics. For example, if Japan wants to use its US$ foreign reserve to buy Iranian oil, America can make that transaction impossible, since all transactions in US$ will ultimately go through an American bank. Even if it's not purchased through US$, if America feel its will were disobeyed, America can even freeze all the US$ foreign reserve of Japan if it wants to, that's valued at JP¥ ~200,000,000,000,000, a really big sum of money.

Many countries and international companies have been sanctioned by America. For example, Iran, Venezuela, Russia, North Korea, China's Huawei, Japan's Toshiba etc.

Not only that, a threatening of sanction is also a powerful weapon. For example, US threatened Germany not to do business with Russia on Nord Stream 2 project, or it will be sanctioned. US also forbid any company to sell products to Huawei if the product contains as little as 10 percent of American technology or components, this is really an outrageous bully action.

"The paper highlights that Brussels is concerned about its 'vulnerability' to the US extraterritorial economic restrictions, as was seen in the situation with Iran after Washington abandoned the multilateral nuclear deal"

America use its sanction power for various purpose. Any country can be targeted by America sanctions, including its so-called ally, this sanction and the threatening of using sanction power give America an extreme power in all kinds of international affairs, it also gives them unfair advantage over almost everything over every country in the world.

Public opinions about this development

One reader's comment read: "America has used its reserve currency to cause economic dislocation to friend and foe alike. It's long past time for that foolishness to end!"

Another comment read: "While the USA seems to have seen sense, the reason why Trump came to power to lead the USA and why so many voted for him this time should have the EU & nations rethinking."

Conclusion

Now is the time to break the US$ hegemony once and for all, the later we do this, the deeper the world is trapped in US$, the more the world will be exploited, and the more difficult to break out of this trap. And all the major powers of the world excluding America have to unite together to do this.

References:

https://www.ft.com/content/20f39e33-e360-479e-82e2-5441d24f0e0b

https://www.rt.com/business/512734-eu-cuts-dollar-reliance/

https://twitter.com/FT/status/1350374277472800769